Insurance

It’s Friday, so time for some more data! Today’s topic is car insurance. I have totaled up all of my car insurance bills since 1995.

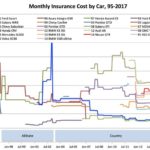

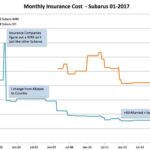

A few observations – Insurance has gone up in the last two years quite a bit, but over the 20 year period it is pretty stable. Part of that stability is the falling prices with driver ago. (me getting old). I change insurance companies two times in those 20 years, first from State Farm to Allstate, then to Country. The large jump in premium in mid 2001 was the result of the only substantial claim when my now ex-wife hit a car on 26, with a total claim of about $10,000. That causes a significant jump in all cars, and a second jump in the WRX later as a result of the car classification changing. A change to Country insurance brought everything back in order.

The drop in 2011-2012 is the result of getting married, which seems to make a significant difference. Rates have creeped up the last 3 years, especially in Oregon, as the result of more claims and significant increases in health care claim costs. It doesn’t help that the GTR is one of the most expensive cars to insure on average.

I have used far less in claims then I paid in, as it should be in an insurance system. Overall average price per car per month is 33% less than the state average, so pretty good overall.